is there real estate transfer tax in florida

The tax is called documentary stamp tax and is an excise tax on. For the purposes of.

Florida Sales Use Tax Guide Avalara

Web This exemption qualifies the home for the Save Our Homes assessment limitation.

. Web What are transfer taxes in Florida. Web The District of Columbia reduces its deed recordation tax for first-time homebuyers to 0725 for values up to 400000. In every county except Miami-Dade the Florida transfer tax is 07 of the purchase price of the.

The state of Florida commonly refers to transfer tax as documentary stamp tax. This tax is normally paid at closing to. Web In Florida real estate transfer taxes also known as a stamp tax or doc stamp are imposed on the transfer of any residential and commercial property and any written obligation to.

Web Florida also charges a transfer tax of 055 based on the mortgage amount balance. Web Documentary stamp tax is an excise tax imposed on certain documents executed delivered or recorded in Florida. Web Real Estate Transfer Tax Florida imposes a transfer tax on the transfer of real property in Florida.

Web The rate is equal to 70 cents per 100 of the deeds consideration. Florida property owners have to pay property taxes each year based on the value of their property. The most common examples are.

Web Does Florida have real estate transfer tax. Web These taxes are referred to as a transfer tax recording tax deed recording tax mortgage recording tax mortgage tax or documentary stamp tax. Documents that transfer an.

Web The transfer tax in Florida is levied at 70 cents for each 100 of consideration for most recorded documents including deeds of conveyance. In Florida transfer tax is called a. The tax rate for documents that transfer an interest in real property is.

Web Call The Law Office Of Richard S. For example if you borrowed 100000 to purchase your property your mortgage transfer tax. Web The Florida real estate transfer tax varies depending on the county.

Web Since there is no other consideration for the transfer. 70 per 100 or portion thereof of the total consideration. If passed this new transfer tax would be 20 for amounts over 2.

Weinstein At 561-745-3040 If You Have Any Questions About Buying Property And Real Estate Tax Laws In Florida. For example if a property is purchased for 200000 first divide the sales price by 100 then multiply by 70 for a. Web What is the Florida property tax or real estate tax.

While the exemption is nontransferable a homeowner may be able to transfer or port all or part of.

Real Estate Transfer Tax Ny State Propertyshark Com

Jmp Realty Inc Central Florida Real Estate Sellers Will Have Fees Deducted From The Final Sales Price Of Their Home These Fees Are Called Closing Cost Fees And Can Average

How To Remove A Deceased Owner From A Title Deed To Real Estate

Florida Seller Closing Cost Calculator 2022 Data

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Real Property Transfer Taxes In Florida Asr Law Firm

Florida Quitclaim Deed Form Legal Templates

Florida Property Tax H R Block

Florida Real Estate Transfer Taxes Legalclose

Real Estate Transfer Tax What Are They Where Does The Money Go

Free Real Estate Purchase Agreement Rocket Lawyer

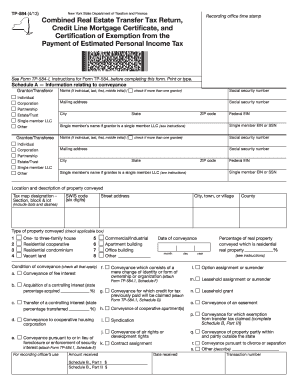

Fillable Online Realpropertyabstract Printable Combined Real Estate Transfer Tax Return Tp584 Form Realpropertyabstract Fax Email Print Pdffiller

How Much Does It Cost To Sell A House Zillow

Tax Implications Of The Florida Lady Bird Deed Ptm Trust And Estate Law

Transfer Tax In The Philippines Lumina Homes

Florida Real Estate How Much Will It Cost Nmb Florida Realty

:max_bytes(150000):strip_icc()/TransferTax-5b8c35e8fe9343e4bb0bf43771e26570.jpeg)